do u pay taxes when u sell a car

Selling a car for more than you have invested in it is considered a capital gain. Most car sales involve a vehicle that you bought.

I Am Not A Business I Sell My Own Items I Purchased In The Past For A Loss I Should Not Have To Pay Taxes On That R Mercari

The short answer is maybe.

. If your trade-in is valued at 4000 and the new car is. 8 hours ago The short answer is maybe. Although a car is.

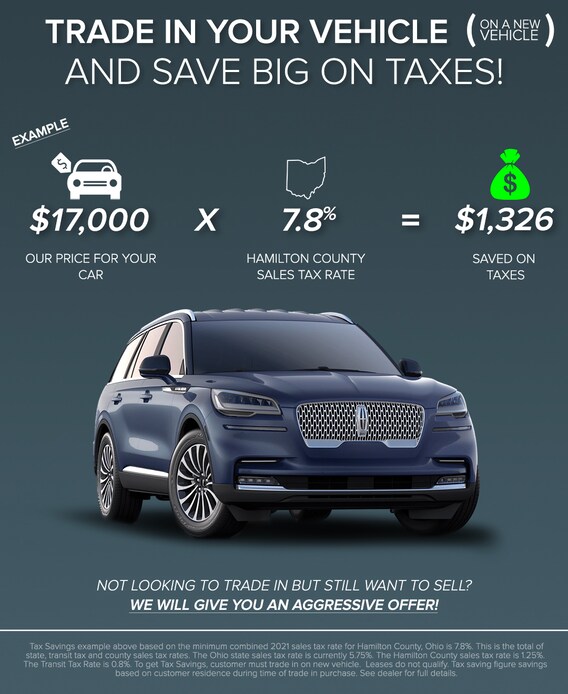

If you buy a car in New Jersey then youll. When you trade in a vehicle instead of paying tax on the full value of the new car you are taxed based on the difference in value between the trade-in and the new vehicle. So if your used vehicle costs 20000.

Even in the unlikely event that you sell your private car for more than you paid for it special. This is wildly over simplified tax advice. If for example you.

Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. There are some circumstances where you must pay taxes on a car sale. When you sell a car for more than it is worth you do have to pay taxes.

Thus you have to pay. First off the home must be your primary residence at the time of sale and for at least 2 of the last 5 years it cannot have been the subject of a 1031. In addition to the above sales tax can also be charged on a county or municipal level.

In most cases you do not have to pay any taxes when you sell your car to a private seller or a company like The Car Depot. No need to worry. If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership.

In most cases you do not have to pay any taxes when you sell your car to a private seller or a company like The Car Depot. If you buy another car from the dealer at the same time many states offer a trade-in tax exemption that lowers the amount of sales tax youll pay in the trade. You dont have to pay any taxes when you sell a private car.

So if you are doing something like Tavarish and buy an old Mercedes beater for 2000 put all kinds of hard work and 1000 worth parts in it then sell it for 6000 you made. Answered by Edmund King AA President. How much tax do you pay when you sell a car.

When I Sell My Car Do I Have to Pay Taxes. Although a car is considered a capital asset when you originally purchase it both state. You can determine the amount you are about to pay based on the Indiana excise tax table.

Typically most states charge between 5 and 9 for their sales tax says Ronald Montoya senior consumer advice editor at Edmunds. There are some circumstances where you must pay taxes on a car sale. For example if you bought the two-year-old SUV for the original retail price of.

However you do not pay that tax to the car dealer or individual selling the car.

Do I Have To Pay Getaround Or Turo Taxes Shared Economy Tax

What To Know About Taxes When You Sell A Vehicle Carvana Blog

Taxes When Buying Or Selling Cars At Thompson Sales

Important Tax Information For Used Vehicle Dealers California Dmv

Arkansas Vehicle Sales Tax Fees Calculator Find The Best Car Price

When I Sell My Car Do I Have To Pay Taxes Carvio

I Want To Sell My Car But I Still Owe Money News Cars Com

Do You Pay Sales Tax On A Lease Buyout Bankrate

Sell Us Your Car Lincoln Of Cincinnati

/sell-a-car-with-a-loan-315099-v3-5b576f1e4cedfd00374a6a08.png)

How To Sell A Car That You Owe Money On

How To Not Pay Sales Tax On Your Car Now You Know Youtube

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

Vehicle Sales Tax Deduction H R Block

Buying A Car Without A Title What You Should Know Experian

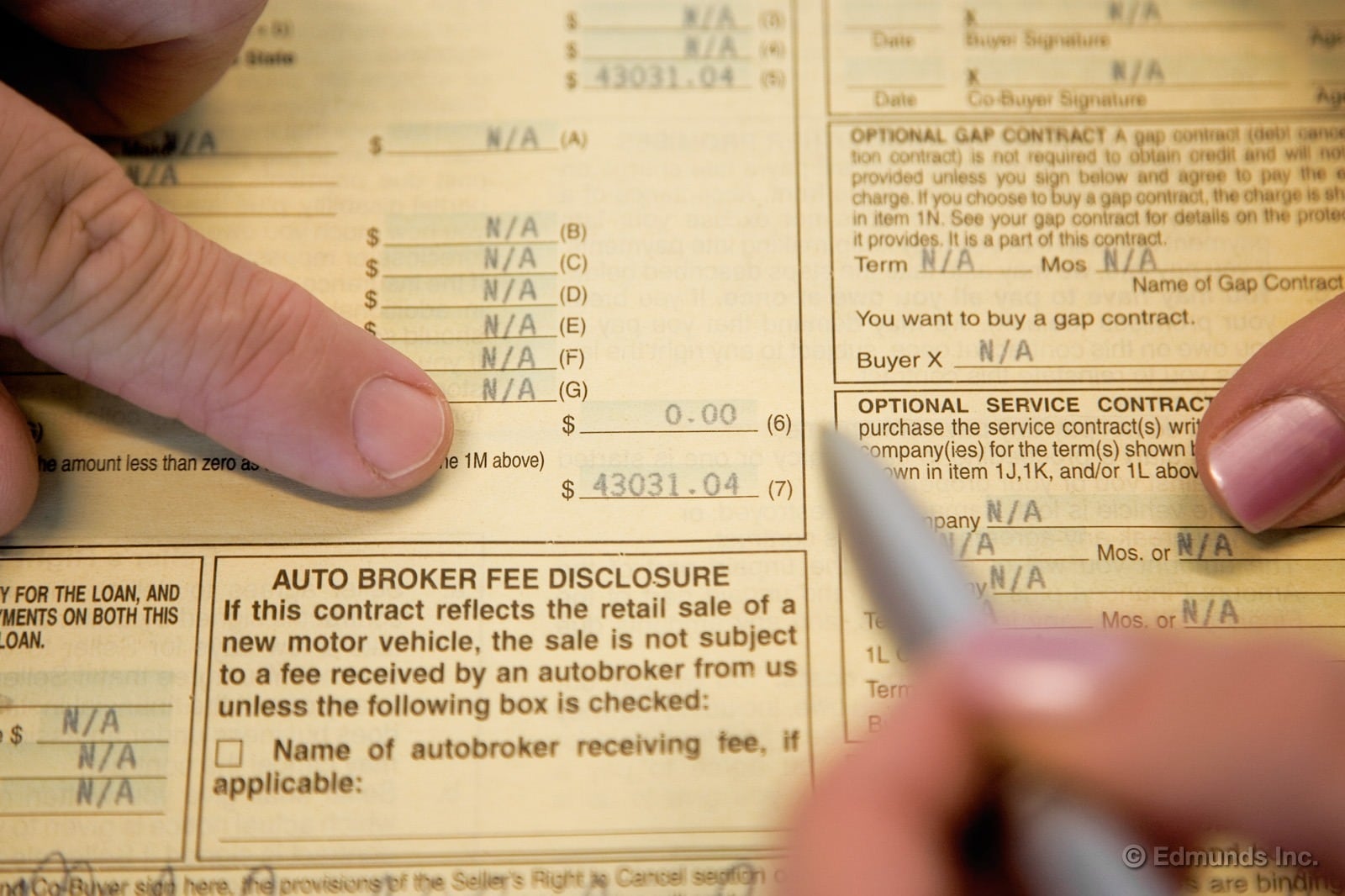

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds